We provide affordable home loans for NRI customers at competitive interest rates. Your dream home is never far away! We assist you to realize your dream home. Avail your Housing Loan from us at competitive interest rates.

The bank charges maximum Rs. Home loan for Non Resident Indians from Indian banks. Check NRI home loan Features and Benefits Eligibility Criteria and Interest Rates.

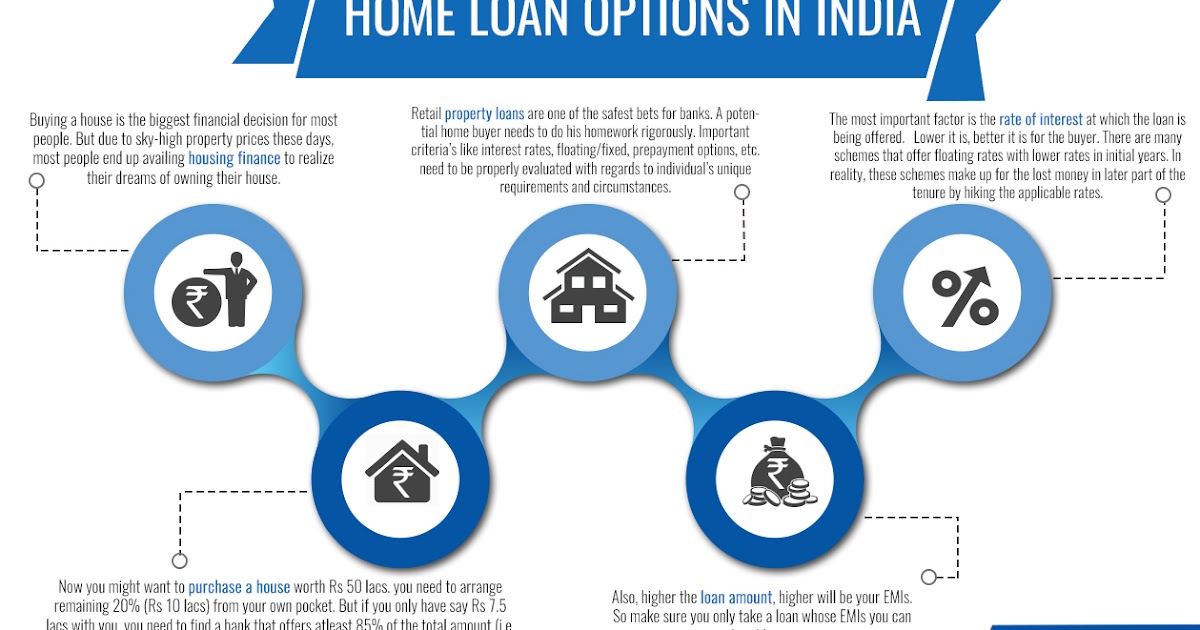

The NRI home loan is offered to people who have been living outside India whose loan tenure, loan amount sanctione and interest rate will depend on the customer’s profile, age of customer at maturity of loan, age of property at loan maturity, depending upon the specific repayment scheme as may be opted and any other terms which may be. By using your property as collateral, lenders are willing to take on more risk than if they were only assessing you by your credit score, which means larger loans and better interest rates. This loan can be availed without any security deposit.

Federal Bank NRI Home Loans Eligibility Criteria. Any home owner can apply for a home equity loan. Check out all details on Axis Bank’s NRI Home Loan. When it comes to making your purchase decision, be sure to explore all the NRI Home Loan Features for more information.

One of the benefits of our NRI Home Loan includes attractive interest rates to avail best returns on your investments. Banks like HDFC, Axis, ICICI, Kotak and SBI provide various home loan schemes for Non-resident Indians (NRIs) and Persons of Indian Origin (PIO). SBI offers the lowest interest rate of 8. SBI NRI Home Loan allows many NRIs (Non Resident Indians) to get home loans when investing in properties. Financially, it makes sense to purchase a property through home loan rather than through personal financing especially when you can invest your personal funds somewhere else for better returns.

Higher interest rate increases your housing loan EMI which will increase the total cost of the loan. Here’s how that works: The rate that moved higher. Home Loan Interest Rate : Reduced home loan interest rates by ICICI. The Bank lowered the MCLR(marginal cost based lending rate ) by 0. For NRIs seeking to buy a home in India, an HDFC Bank Home Loan is a great way to fund that investment.

Attractive interest rates, transparent processes and costs, minimal documentation, quick disbursals and expert guidance make HDFC Bank Home and Home Improvement Loans attractive for NRIs. Know details on Eligibility, Documents required and Process of NRI Home Loans. The maximum quantum of loan is of the Home Loan amount subject to a ceiling of Lakhs. Loan repayment should not exceed the remaining period of the existing housing loan. SBI links its home loan rates of interest to the repo rate.

SBI (State Bank of India) has announced a new housing loan scheme that can change the way how floating- rate housing loans are priced. If you see Indiabulls offering the best interest rate on home loans in India, then register your interest with us. Get Instant Personal Home Loan from South Indian Bank. Generally, an NRI home loan follows the same system and structure as a normal process of home loan in India, the only difference lies in the interest rate and tenure. The interest rate for NRI home loans is slightly on the higher side and the loan tenure is lower in comparison to the normal home loans provided to Indian residents.

Loan Schemes - Interest Rates Marginal Cost of fund based lending rate Interest Rate For Borrowers Other Than P Segment - Commercial Loans SME Interest Range SMEBU years interest rate Interest Rates On Pre Shipment Credit And Export Bill Discounting in Foreign Currency Loans Interest Rates On FCNB Loans To Exporters Corporates Processing. Interest Rate check eligibility Doorstep Service EMI calculator Processing Fees festival offer – iServefinancial. Get loan tenure from year to years.

Enjoy flexible repayment options. Home Loan For NRI - Know More About Home Loans Specially Tailored For Nri Citizens. Loan schemes for NRIs include apart from the usual personal loans, home loans , loan against deposits, etc.

We have different schemes for different purposes. Home Loan for NRIs: Get quick and easy home loans at an attractive housing finance rates with Axis Bank. Get interest rates for NRI home loans here.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.