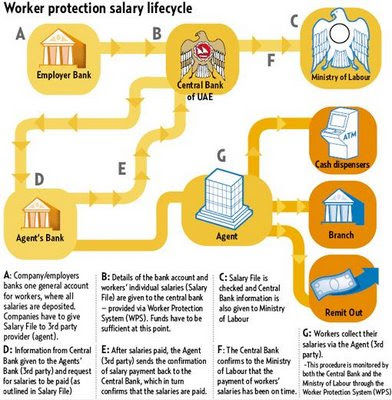

What is the Wage Protection System ( WPS )? The Wage Protection System was set up to ensure that companies within the UAE pay their staff correctly. Under this system , salaries of employees will be transferred to their accounts in banks or financial institutions, which are authorised by Central Bank of the UAE to provide the service. MoHRE will not process any transactions or deal with the owners of the companies that are not registered with the WPS until they register in the system.

As explained by Mohre’s Wages Protection System User Manual PDF , WPS is an electronic salary transfer system that allows companies to pay workers their wages through banks, bureaux de change, and financial institutions that are approved and authorized to provide the service. Upon formation, all onshore companies are required to create an account with the Ministry of Labour that records and regulates the issuing of contracts and visas to employees. It is hosted at the Central Bank. Introduction Wage Protection System or WPS is an electronic salary transfer system that allows organizations to pay employees’ wages through banks, bureaux de change and other authorized financial institutions. The WPS technique was developed by the Central Bank of the United Arab Emirates.

Can the employer choose any service provider for availing WPS facility? The wage protection system ensures that wages are paid out fairly to all employees of private sector organizations. Wages Protection System ( WPS ) is an initiative, by the UAE Ministry of Labour in association with UAE Central Bank, to streamline salary disbursal process across the UAE. Probation periods are capped at a maximum of six months. The system is in place to safeguard both Saudi and expat employees.

BUSINESS enables you to make a range of Banking Transactions. Initiate salary payments to local and international employee accounts with any bank. Make payments towards Immigration VISA using e-Wallet Services. With WPS , the Ministry of Labor can now track whether salaries are being been paid on time or not, and impose penalties on employers when necessary. Here is a step by step guide to create WPS Sif File to transfer salaries through WPS.

Definition of WPS : Wages Protection System , SIF File: Salary Information File. Opening a new salary file (Excel) 2. Entering the requisite Employee Salary details. This article briefly outlines key issues in the UAE concerning payment of remuneration, authorised salary deductions and the wages protection system ( WPS ). Payment of remuneration Under the UAE Labour Law, employees employed on an annual or monthly basis should be paid at least once a month. UAE decree: UAE to act tough on firms that delay wages. Wages Protection System (WPS) is an electronic salary transfer system that allows institutions to pay workers’ wages via banks, bureau x de change, and financial institutions approved and authorized to provide the service.

According to the decree, the ministry will neither process any transactions nor deal with the owners of the companies that are not registered with the Wage Protection System ( WPS ) until they register in the system. WPS or Wage Protection System is an easy and user friendly solution for processing UAE employee’s salary system imposed by the UAE Central bank and UAE Ministry of Labor as requirements to be followed by the companies. The objective of UAEWPS is to provide a Safe, secure, efficient and robust mechanism to streamline the timely payment of wages to employees by their employers.

UAE businesses must adhere to timely wage payments that match the initial offer letter and local labor contract. Built-in technology ensures 1 confidentiality and data security. WPS-compliant fund transfer at all UAE Exchange branches. Principal membership with MasterCard for payroll solutions.

Software maintains all the records of the salaries given to the employees and provide detailed and summary reports. WPS Salary Processing System checks and validate information and creates a perfect SIF file as per the Central Bank requirements.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.